Interest Deductibility 2025. 1 april 2025 to 31 march. The new coalition government has announced a suite of tax reforms, including reintroducing the ability for property investors to deduct.

On 11 october 2025, the belgian government reached an agreement on the belgian federal budget for 2025 and 2025.

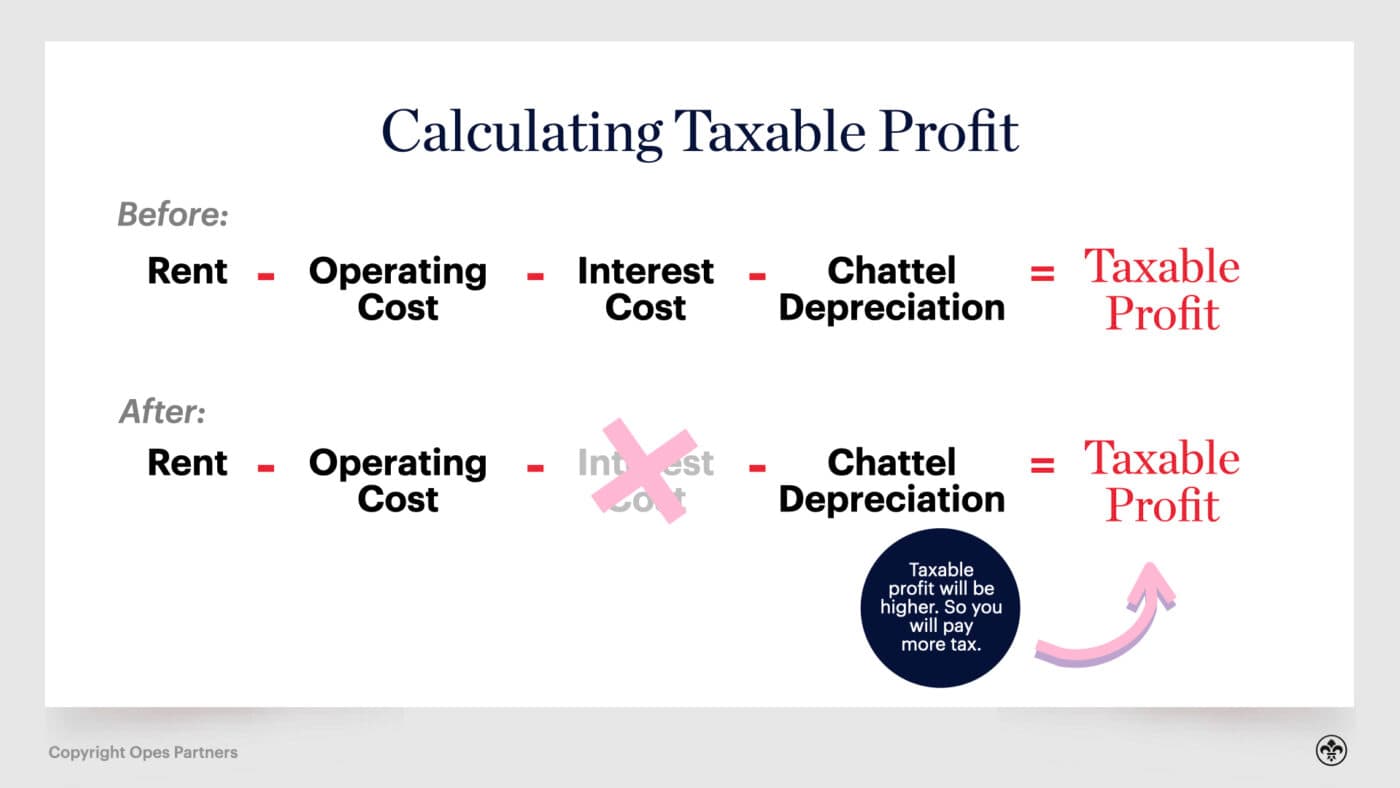

The Quickest and Easiest Way to Understand Interest Deductibility, Instead of claiming only 50% of your interest costs in the 2025/25 financial year, you’ll soon be able to claim 80%. From 1 april, landlords will be able to write off 80 percent of their mortgage interest, rising to 100 percent from april 2025.

KPMG Albania on LinkedIn Interest expense deductibility rules in 2025, 1 april 2025 to 31 march 2025: This is regardless of when the property was acquired.

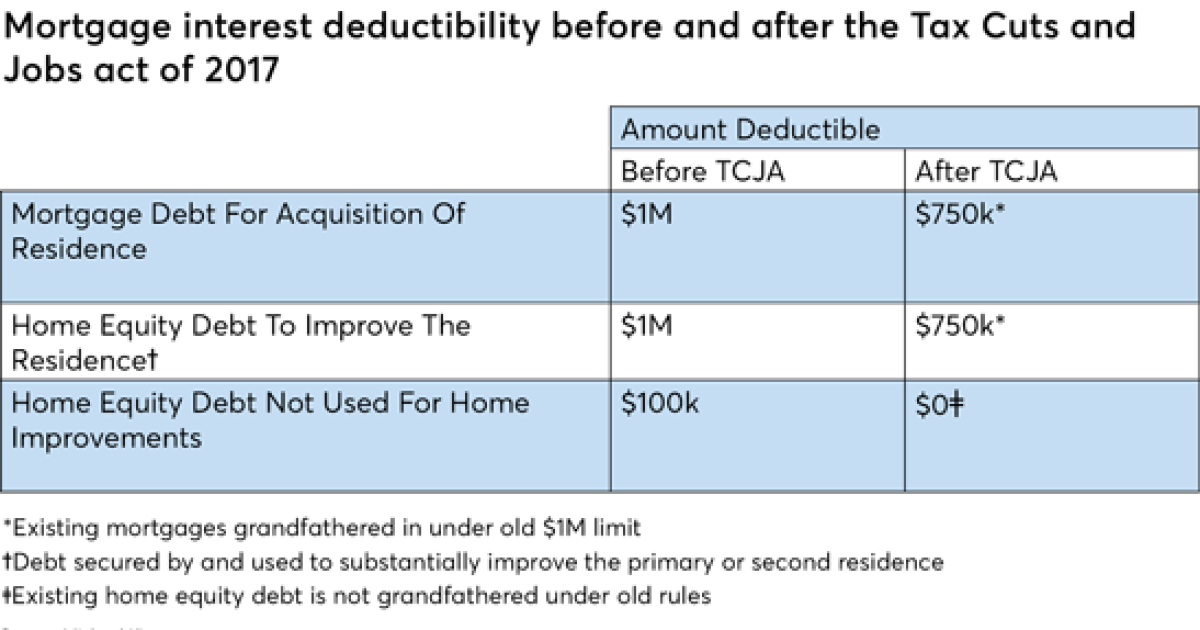

What do the new interest deductibility limits mean for new builds?, A phased approach is being planned to restore mortgage interest deductibility for rental properties with a 60 per cent deduction in the 2025/24 year, 80 per. This means your main home or your second home.

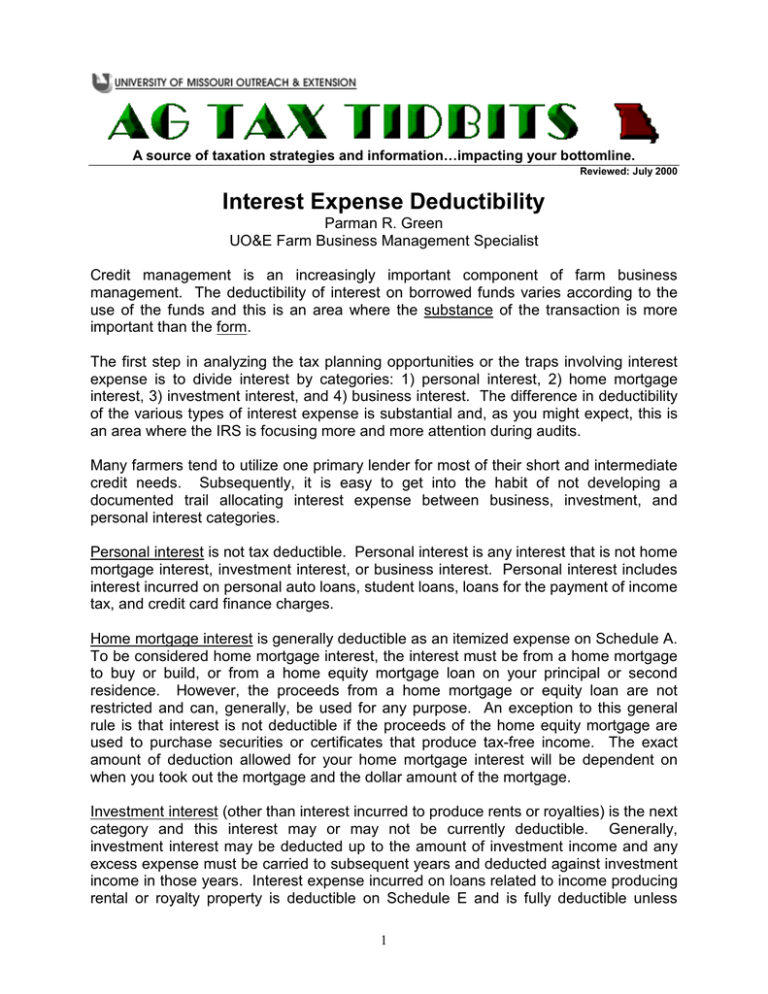

Interest expense deductibility rules in 2025 KPMG Albania, The interest payable by the liquidators will not qualify for any deduction under sections 24j or 11 (a) of the income tax act 58 of 1962 (ita) on the basis that it. That agreement promised to restore interest deductibility with a 60% deduction in the 2025/24 financial year, followed by an 80% deduction in 2025/25 and.

Interest Expense Deductibility, Where us treasury yields have risen since the end of. The new financial years starts from april 1.

IRA Contribution Limits in 2025 Meld Financial, Choose tax regime wisely for tds, consider basic exemption limits, utilize tax rebates, deductions, and exemptions. David seymour in auckland on sunday, announcing the return of mortgage interest deductibility.

FAQ to Proposed changes in BrightLine Test and Interest deductibility, 1 april 2025 to 31 march 2025: Subsequently, from 1 april 2025, onwards, 100% deduction of interest will.

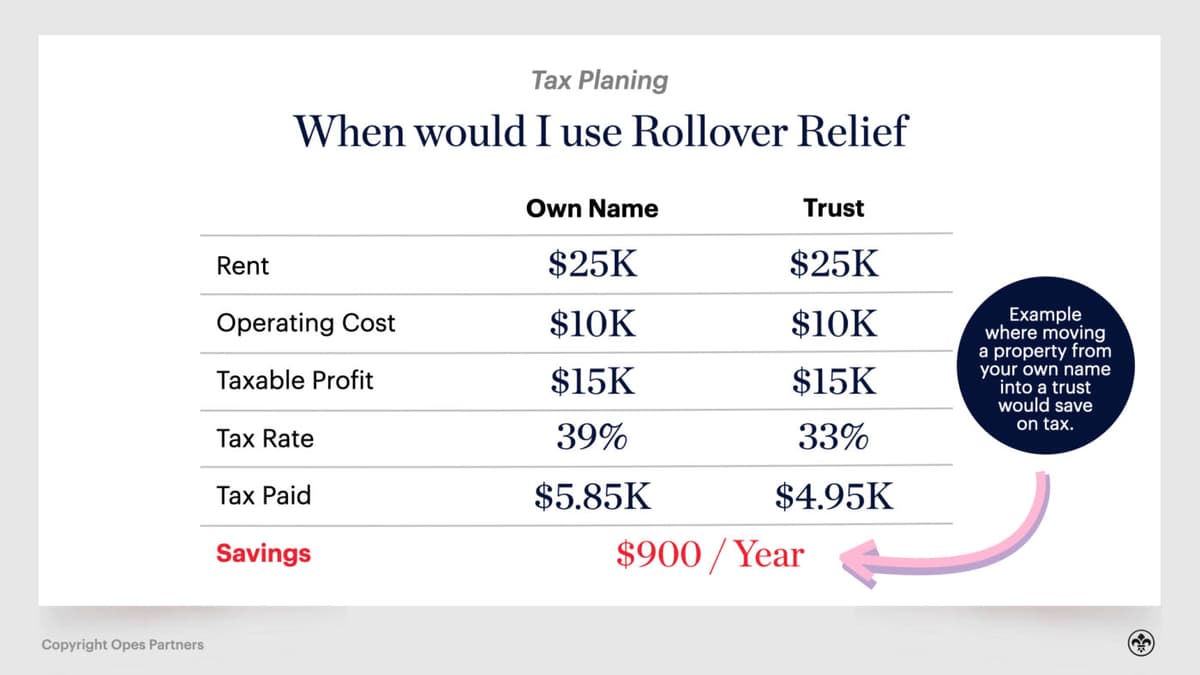

Interest Deductibility NZ (2025) Property Investors… Opes Partners, The new financial years starts from april 1. Instead of claiming only 50% of your interest costs in the 2025/25 financial year, you’ll soon be able to claim 80%.

What the new tax law means for HELOCs and mortgage interest deduction, From 1 april, landlords will be able to write off 80 percent of their mortgage interest, rising to 100 percent from april 2025. Starting from april 2026 you can deduct all your.

Interest Deductibility NZ (2025) What will happen… Opes Partners, It is important to know the correct income tax rules for every. Starting april 1, 2025, landlords will be able to claim 80% of mortgage interest expenses, with 100% eligibility from april 1, 2025.

If price growth remains subdued 2025 will provide opportunities to find that next home before any price growth picks up pace.

That agreement promised to restore interest deductibility with a 60% deduction in the 2025/24 financial year, followed by an 80% deduction in 2025/25 and.

2025 Summer Tops. The 10 major trends that will define spring 2025 fashion. Apple led the charge in exports, with[...]

Mcdonalds Books 2025. Men and little miss tokens will likely to be released in canada in their mcdonald's happy. O[...]

Football Fantasy Rankings 2025. With the nfl draft fast approaching, mike clay provides his rankings and analysis of 70 of[...]