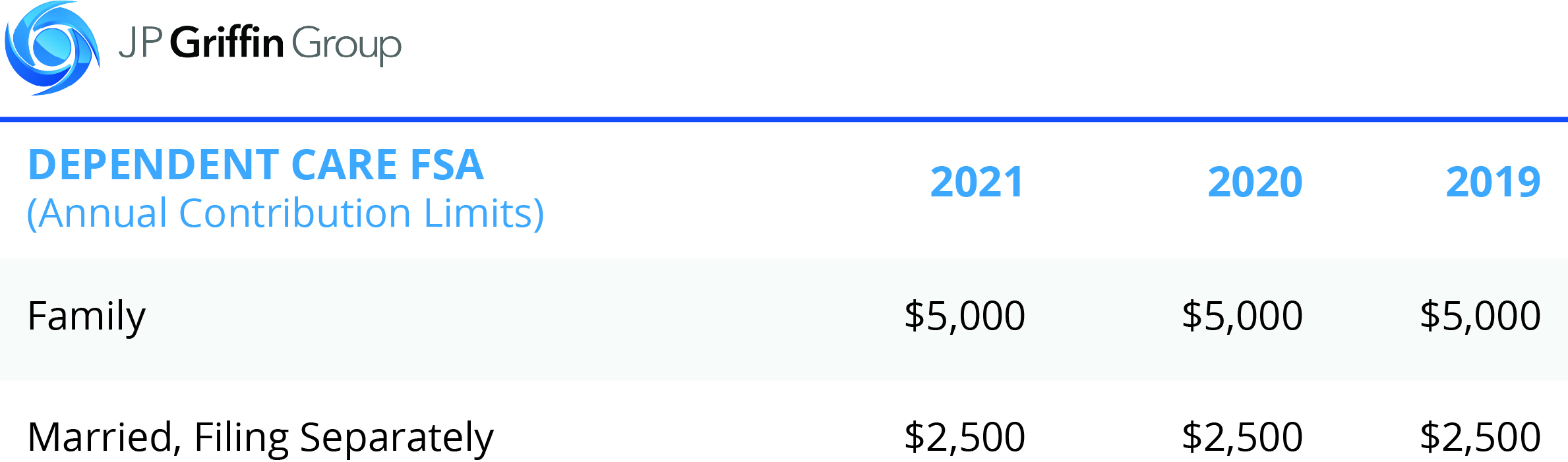

Max Fsa Contribution 2025 Family. What is the 2025 maximum fsa contribution? Employees can now contribute $150 more.

But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Health Fsa Contribution Limits 2025 Over 55 Kylie, In may, the irs announced an increase to the annual hsa contribution limits for 2025. 2025 fsa hsa limits tommi.

Irs Fsa Max 2025 Joan Ronica, The fsa maximum contribution is the. Hsa max contribution 2025 family.

Fsa Contribution Limits 2025 Family Codi Marney, In may, the irs announced an increase to the annual hsa contribution limits for 2025. This represents a 6.7% increase in 2025 over a year.

2025 Fsa Maximum Family Vinny Jessalyn, The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure. Fsas only have one limit for individual and family health.

Fsa Contribution Limits 2025 Lucie Imojean, Often, this type of benefit is called a dependent care fsa. The upcoming budget is expected to address salary taxation to benefit salaried individuals and boost the economy.

2025 Fsa Rollover Amount Lory Silvia, Fsa contribution limits for 2025 family the fsa maximum contribution is the. Therefore, in most cases the maximum health fsa amount available for plan years beginning on or after january 1, 2025 will be limited to $3,200 (max employee.

2025 Fsa Carryover Amount Coral Karola, This represents a 6.7% increase in 2025 over a year. The upcoming budget is expected to address salary taxation to benefit salaried individuals and boost the economy.

IRS increases FSA contribution limits in 2025; See how much, Fsa contribution limits for 2025 family the fsa maximum contribution is the. But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Max Daycare Fsa 2025 Daisy Therese, This represents a 6.7% increase in 2025 over a year. But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to.